App World

My stream

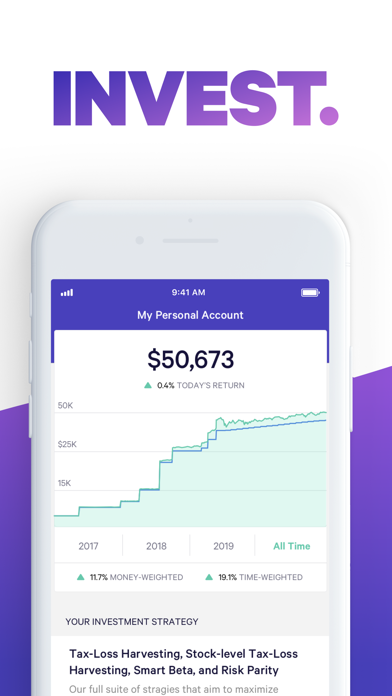

Wealthfront

Save. Plan. Invest. Earn more on your cash, get advice on how to manage your savings, and automate your invest...

Free

Store review

Save. Plan. Invest.

Earn more on your cash, get advice on how to manage your savings, and automate your investments at a low cost.

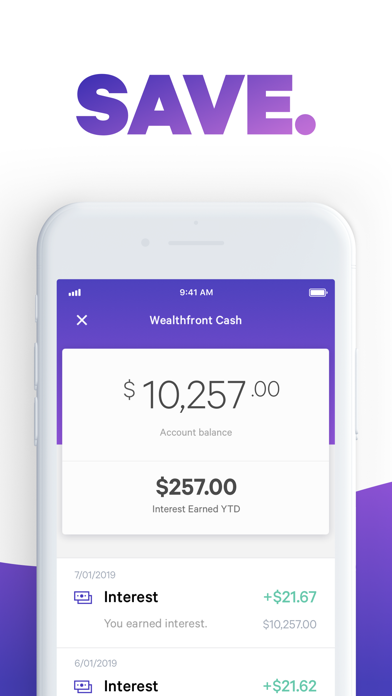

Grow your cash faster

Open a Wealthfront Cash Account right in the app and earn more than 5x the national average interest according to FDIC.gov*. Your cash is covered by FDIC Insurance up to $1 million through our partner banks so you can feel confident that your money is safe. No fees, zero market risk, and unlimited free transfers.

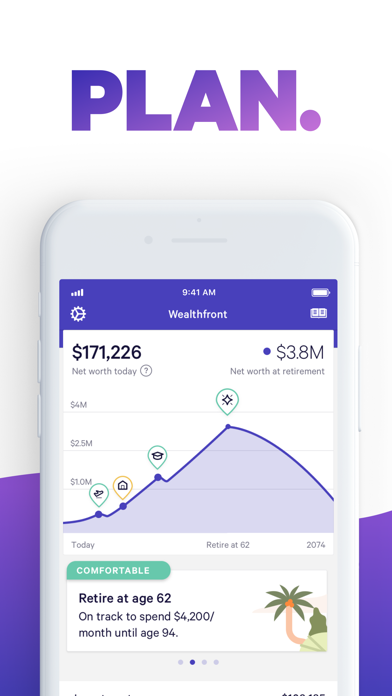

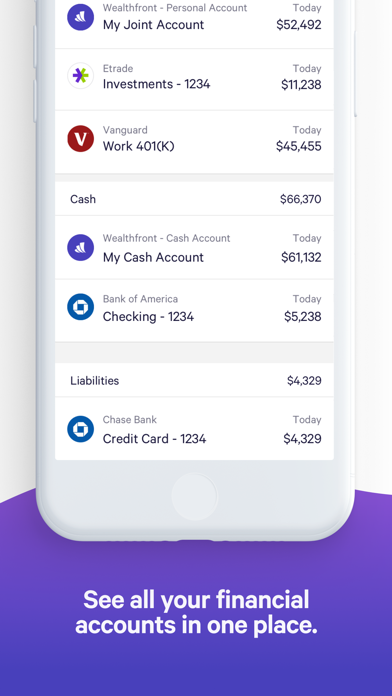

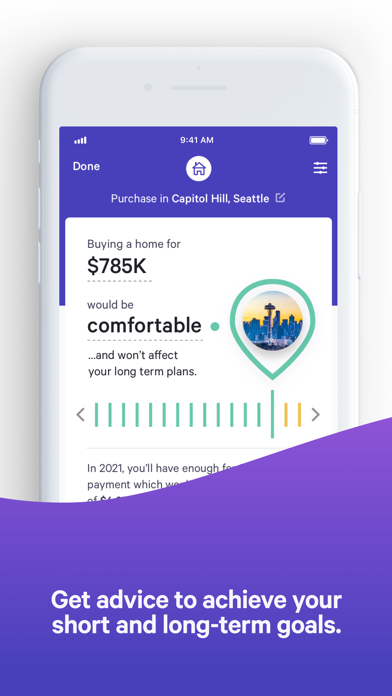

Free financial guidance tailored to you

After linking your financial accounts, find out if you’re on track. We’ll give you insights into how early you can retire or in what neighborhood you can buy a home. Plan for both your short and long-term goals, and we’ll give you guidance on how to make it all happen.

Invest while keeping fees & taxes low

Through our software-only approach, we invest your money in a globally diversified portfolio of low-cost index funds, and our tax-loss harvesting strategies help lower the taxes you pay.

Borrow quickly & easily with a Portfolio Line of Credit

Portfolio Line of Credit is the fast, easy and convenient way to access cash. No application, no credit check, and you get the cash you need without selling investments and disrupting your strategy.

*Source: FDIC.gov as of 1/13/20. National rates are calculated based on a simple average of rates paid (uses annual percentage yield) by all insured depository institutions and branches for which data are available. Savings and interest checking account rates are based on the $2,500 product tier.

The Annual Percentage Yield (APY) for the Cash Account may change at any time. Wealthfront Brokerage conveys Cash Account funds to depository institutions that accept and maintain such deposits. The cash balance in the Cash Account is swept to one or more banks (the “Program Banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the Program Banks. While funds are at Wealthfront, before they are swept to the program banks, they are subject to SIPC’s protection limit of $250,000 for cash. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront Brokerage uses more than one Program Bank to ensure FDIC coverage of up to $1 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the Program Banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at Program Banks are not covered by SIPC.

Portfolio Line of Credit is a margin lending product offered exclusively to clients of Wealthfront Advisers by Wealthfront Brokerage LLC. You should consider the risks and benefits specific to margin when evaluating your options. Learn more about these risks in the Margin Handbook (www.wealthfront.com/static/documents/wbc/margin_handbook.pdf)

Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security or a financial product. Please see www.wealthfront.com/legal/disclosure for important details.

Wealthfront, Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

© 2020 Wealthfront Corporation. All rights reserved.

4

out of

9956 reviews

Size

64.2 MB

Last update

June 7, 2020

Facebook

Facebook Twitter

Twitter Google plus

Google plus